On Wednesday, the Federal Reserve made a significant move by cutting interest rates by 0.5%. This marks a clear response to slowing economic conditions and signals a shift in monetary policy designed to stimulate growth. Let’s break down what this means for consumers, investors, and the broader economy.

Why the Rate Cut Happened

The decision to lower rates by 0.5% indicates the Fed is concerned about a potential economic slowdown. This could be due to factors like softening consumer spending, global economic uncertainty, or signs of cooling inflation. The rate cut is designed to make borrowing cheaper and boost spending, both by consumers and businesses, which in turn can help fuel economic growth.

Impact on Borrowers

For individuals with loans or credit cards, this cut could be good news. If you have variable-rate debt—such as credit cards, adjustable-rate mortgages, or personal loans—you might see your interest rates go down. Is it a time to refinance existing loans at a lower rate? My rule of thumb—waiting for at least a 2% drop in mortgage rates before considering refinancing. You might have been or will be offered a "no-cost" refinance from your bank or lender. The truth is there’s no such thing as a free refinance. There’s always a cost; you just may not see it or pay out of pocket immediately. If you are contemplating on refinancing, let's run the numbers and I'll show you that the numbers never lie. Sometimes the most critical numbers of your real costs are skillfully hidden among all the other less relevant figures!

For those in the market to buy a home or a car, the lower rates can make borrowing more attractive. Mortgage rates are likely to decrease as well, making this a more attractive time to get back into the market if you’ve been shopping for a while!

Impact on Savers

On the flip side, savers may feel the pinch. With lower interest rates, savings accounts and other interest-bearing accounts will offer less attractive returns. If you rely on interest income from high-yield savings or certificates of deposit (CDs), this rate cut could mean you’ll earn less over time. It’s worth considering alternative investment options if you’re looking to maintain higher yields, though these often come with increased risk. However, always remember that not taking enough risk is also a risk!

Impact on Investors

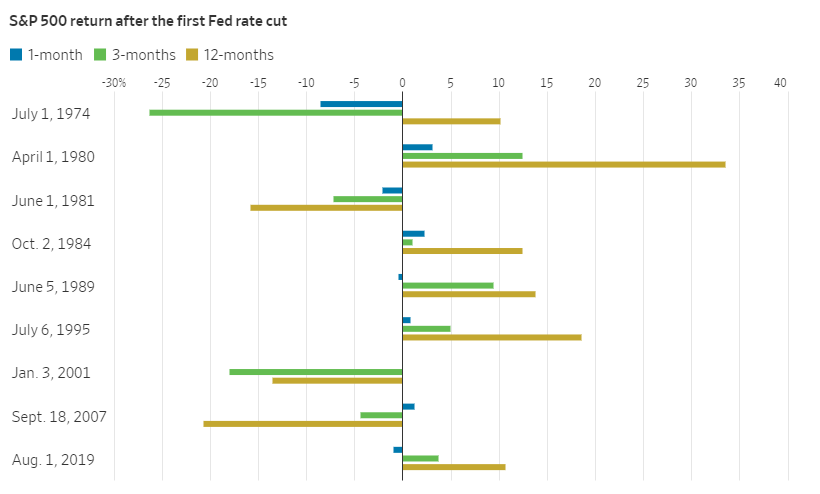

Historically the stock market tends to react favorably to rate cuts, as lower borrowing costs can lead to increased spending and investment by businesses, which can boost corporate profits. You might see positive movement in equities, especially in sectors like real estate, technology, and consumer discretionary, which benefit from lower financing costs. According to LPL Financial, stocks have historically traded flat to negative in the first few months after a rate-cutting cycle begins, but tend to move higher over the following 12 months.

However, it’s important to keep an eye on the bigger picture. The Fed typically cuts rates in response to signs of economic weakness, which means that even though stocks may rise, underlying economic challenges remain. Investors should stay invested in a diversified portfolio that is aligned with their goals.

The Bigger Picture

While a 0.5% rate cut can provide short-term relief and stimulate economic activity, it also raises questions about the long-term outlook. Lower rates can encourage borrowing and investment for now, but they can also lead to inflationary pressures if the economy overheats, just like what we've had in 2022 during Covid-19 pandemic. Additionally, the Fed has fewer tools to combat future downturns when rates are already low.

What Should You Do?

If you have debt, run the numbers to find out if it's a good time for refinancing. We might see a series of further rate cuts in the next couple of years so wait and see is not a bad strategy if the numbers don't make sense now. If you’re a saver, consider exploring investment opportunities beyond traditional savings accounts to maintain growth in your portfolio. As an investor, stay diversified and be prepared for potential volatility in the markets as the long-term effects of the rate cut unfold.

As always, it’s a good idea to discuss your financial strategy with a professional to ensure you’re making the best decisions in this evolving economic environment.

Comments